Viewing content for

Mutual Income Solutions - DI

Mutual Income Solutions - DI

State Selected

State Selected

State Selection

State Selection

Select Your State:

We want to make sure you get the appropriate information on products approved for sale in your state.

Product Unavailable

Product Unavailable

Web Content Viewer

Web Content Viewer

Building on the Company’s Long History

Mutual Income Solutions builds on Mutual of Omaha’s more than 100 years’ experience providing income protection solutions to our customers. With a maximum monthly benefit of up to $20,000 per month, Mutual Income Solutions provides flexible or customizable coverage to meet your clients’ needs and help protect their lifestyle.

Web Content Viewer

Web Content Viewer

Product Highlights

Here are the highlights of Mutual Income Solutions:

- Higher monthly benefit amounts help you target the

affluent market - A non-cancelable policy type, which is attractive for

white-collar occupations - Optional benefits, including a return of premium rider,

allow your clients to customize their policies - Optional benefits allow your clients to customize their policies

- Discounts for which your clients may be eligible can help

them save money

Web Content Viewer

Web Content Viewer

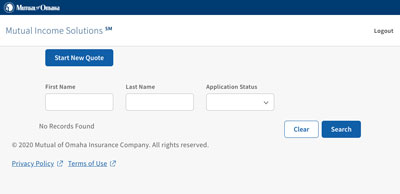

e-Application & Quote Tools

Run a quote online any time of day and use Mutual Income Solutions e-Application to submit business quickly.

Start e-App

Web Content Viewer

Web Content Viewer

Sales & Marketing Materials

Use these materials to start the income replacement conversation with your clients.

Product Information

Learn about the product details.

- Product Guide

- Product Approval Map

- Sample Policy Accident Sickness - Guaranteed Renewable

- Sample Policy Accident Sickness - Guaranteed Renewable

- Sample Policy Accident Sickness - Non-Cancelable

- Sample Policy Accident Sickness - Non-Cancelable

- Sample Policy Accident Only - Guaranteed Renewable

- Sample Policy Accident Sickness – Guaranteed Renewable (DE)

- Sample Policy Accident Sickness – Non-Cancelable (DE)

- Sample Policy Accident Only - Guaranteed Renewable (DE)

- Sample Policy Accident Sickness - Guaranteed Renewable (FL)

- Sample Policy Accident Sickness – Non-Cancelable (FL)

- Sample Policy Accident Only - Guaranteed Renewable (FL)

- Sample Policy Accident Sickness – Guaranteed Renewable (MT)

- Sample Policy Accident Sickness – Non-Cancelable (MT)

- Sample Policy Accident Only - Guaranteed Renewable (MT)

- Sample Policy Accident Sickness – Guaranteed Renewable (ND)

- Sample Policy Accident Sickness – Non-Cancelable (ND)

- Sample Policy Accident Only - Guaranteed Renewable (ND)

- Sample Policy Injury Sickness - Guaranteed Renewable

- Sample Policy Injury Sickness - Non-Cancelable

- Sample Policy Injury Only - Guaranteed Renewable

- Sample Policy Accident Sickness – Guaranteed Renewable (SD)

- Sample Policy Accident Sickness – Non-Cancelable (SD)

- Sample Policy Accident Only - Guaranteed Renewable (SD)

- Sample Policy Accident Sickness – Guaranteed Renewable (WY)

- Sample Policy Accident Sickness – Non-Cancelable (WY)

- Sample Policy Accident Only - Guaranteed Renewable (WY)

Underwriting Information

Complete information on underwriting requirements and processes.

Web Content Viewer

Web Content Viewer

Product Overview

Accident and Sickness DisabilityInjury and Sickness Disability |

Accident Only Disability*Injury Only Disability |

|

|---|---|---|

Issue Ages |

18-61 |

18-61 |

Guaranteed Renewability |

Guaranteed renewable to age

67 |

Guaranteed renewable to age

67; |

Noncancelable |

Noncancelable to age

67; |

N/A |

Occupational Classes |

6A ,5A, 4A, 3A, 2A, 1A, 5M, 4M, 3M, 2M 6A ,5A, 4A, 3A, 5M, 4M, 3M |

6A ,5A, 4A, 3A, 2A, 1A, 5M, 4M, 3M, 2M |

Maximum Monthly Benefits |

$20,000 |

$5,000 |

Elimination Period (calendar days) |

30, 60, 90, 180, 365, 730 |

30, 60, 90, 180, 365, 730 |

Benefit Period |

6 mo., 1, 2, 5, 10 5, 10 |

6 mo., 1, 2, 5, 10 |

Base Benefits |

|

|

Optional Benefits |

|

|

Underwriting |

Simplified, up to $6,000 monthly benefit |

Simplified, up to $5,000 monthly benefit |

Premium Discounts*** |

|

|

Premium Payment Options |

|

|

Note: Elimination Period and/or benefit period may vary by state. Features and riders may not

be available with all policies or approved in all states.

* Accident Only Disability is not available in California

** Social Insurance Supplement rider required on

2A, 1A, & 2M occupational classes to obtain maximum monthly benefit

*** Percentage and/or available discount

may vary by state.

**** Either Residual Disability or Enhanced Residual Disability is required in California.

**** Mental or Nervous Disorder and Substance Abuse Benefits Extension is required in Vermont.

Note: Elimination Period and/or benefit period may vary by state. Features and riders may not

be available with all policies or approved in all states.

* Social Insurance Substitute rider required on

2A, 1A, & 2M occupational classes to obtain maximum monthly benefit

** Percentage and/or available discount

may vary by state.

Web Content Viewer

Web Content Viewer

Mutual Income Solution Videos

Web Content Viewer

Web Content Viewer

Introducing our New DI Product

Learn how the difference is obvious with Mutual Income Solutions.

Length 02:10

Consumer Video: Disability Income Insurance Helps Protect the Way You Live

Help your clients understand the need for disability income insurance.

Length 01:47

Web Content Viewer

Web Content Viewer

Mutual Income Solutions Overview

Help your clients understand that their income is their most valuable asset.

Length 03:40

Mutual Income Solutions Product Details

Learn how a Mutual Income Solutions policy can be customized to meet your clients’ needs.

Length 05:13

Web Content Viewer

Web Content Viewer

Mutual Income Solutions Optional Riders – Part 1

Learn about our optional riders, which can enhance a Mutual Income Solutions policy.

Length 03:13

Mutual Income Solutions Optional Riders – Part 2

Learn about our optional riders, which can enhance a Mutual Income Solutions policy.

Length 04:51

Web Content Viewer

Web Content Viewer

Sales Idea: Protecting Your Clients’ Mortgages

Learn how disability income insurance can protect your clients’ home, savings and lifestyle.

Length 01:47

Sales Idea: Supplementing Employee Benefit Plans

Your clients can benefit from additional coverage to enhance their existing disability coverage.

Length 02:29

Web Content Viewer

Web Content Viewer

Sales Idea: Return of Premium Rider Offers Refund Option

Learn how your clients could get back a portion of their Mutual Income Solutions premium payments.

Length 01:44

Sales Idea: Protecting Self-Employed Individuals

Self-employed individuals have unique needs because they rely on income from their business.

Length 01:25

Web Content Viewer

Web Content Viewer

Market Profile: Optometrist

Learn about the types of disability income insurance policies typically purchased by optometrists.

Length 03:32

Market Profile: Attorney

Learn about the types of disability income insurance policies typically purchased by attorneys.

Length 03:26

Web Content Viewer

Web Content Viewer

Market Profile: Engineer

Learn about the types of disability income insurance policies typically purchased by engineers.

Length 03:48

Underwriting Guidelines

Get an overview of our Mutual Income Solutions underwriting guidelines.

Length 03:45

Web Content Viewer

Web Content Viewer

Materials to Help Boost Your DI Sales Efforts

Target clients and prospects who are a great fit for Mutual Income Solutions.

Length 03:38

Web Content Viewer

Web Content Viewer

Error

Something went wrong - Please report this problem to the portal administrator.

Web Content Viewer

Web Content Viewer

Login

Login

There's More

Log in to Sales Professional Access to unlock even more detailed information and specialized tools plus your personalized reports.

Not Registered? All you need is your production number and you're ready. Sign up

Shared State Special JS

Shared State Special JS

Contact Support

Contact Support

Have a sales or marketing question, need technical assistance, or have an idea you want to share? Contact Support