Viewing content for

Life Underwriting

Life Underwriting

State Selected

State Selected

State Selection

State Selection

Select Your State:

We want to make sure you get the appropriate information on products approved for sale in your state.

Product Unavailable

Product Unavailable

Web Content Viewer

Web Content Viewer

Error

Something went wrong - Please report this problem to the portal administrator.

Overview and Phone Number - Life Underwriting

Overview and Phone Number - Life Underwriting

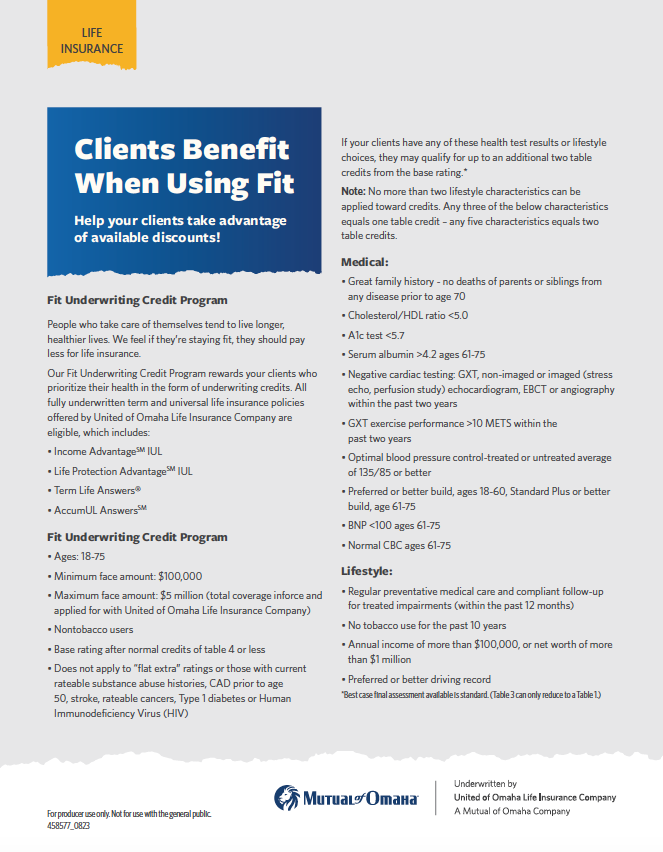

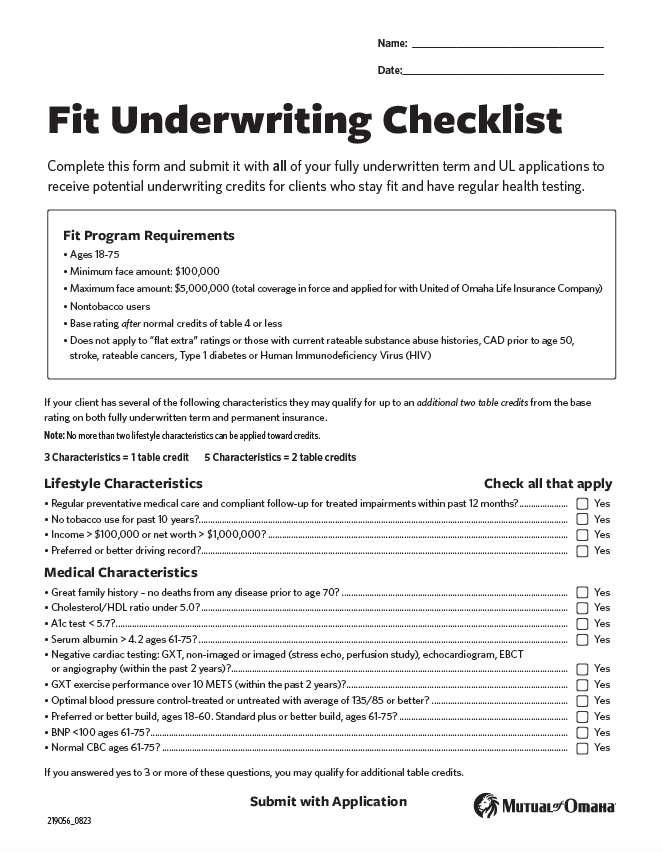

The Life Underwriting Team is experienced, knowledgeable and eager to help you place business quickly. Underwriters review cases carefully to determine if Fit underwriting credits apply and to give your clients the best offer.

Contact Underwriting: (800) 775-7896

Monday-Friday 8:00 a.m. - 4:30 p.m. CST

Web Content Viewer

Web Content Viewer

Error

Something went wrong - Please report this problem to the portal administrator.

Web Content Viewer

Web Content Viewer

Error

Something went wrong - Please report this problem to the portal administrator.

Fit Program - Life Underwriting

Fit Program - Life Underwriting

Web Content Viewer

Web Content Viewer

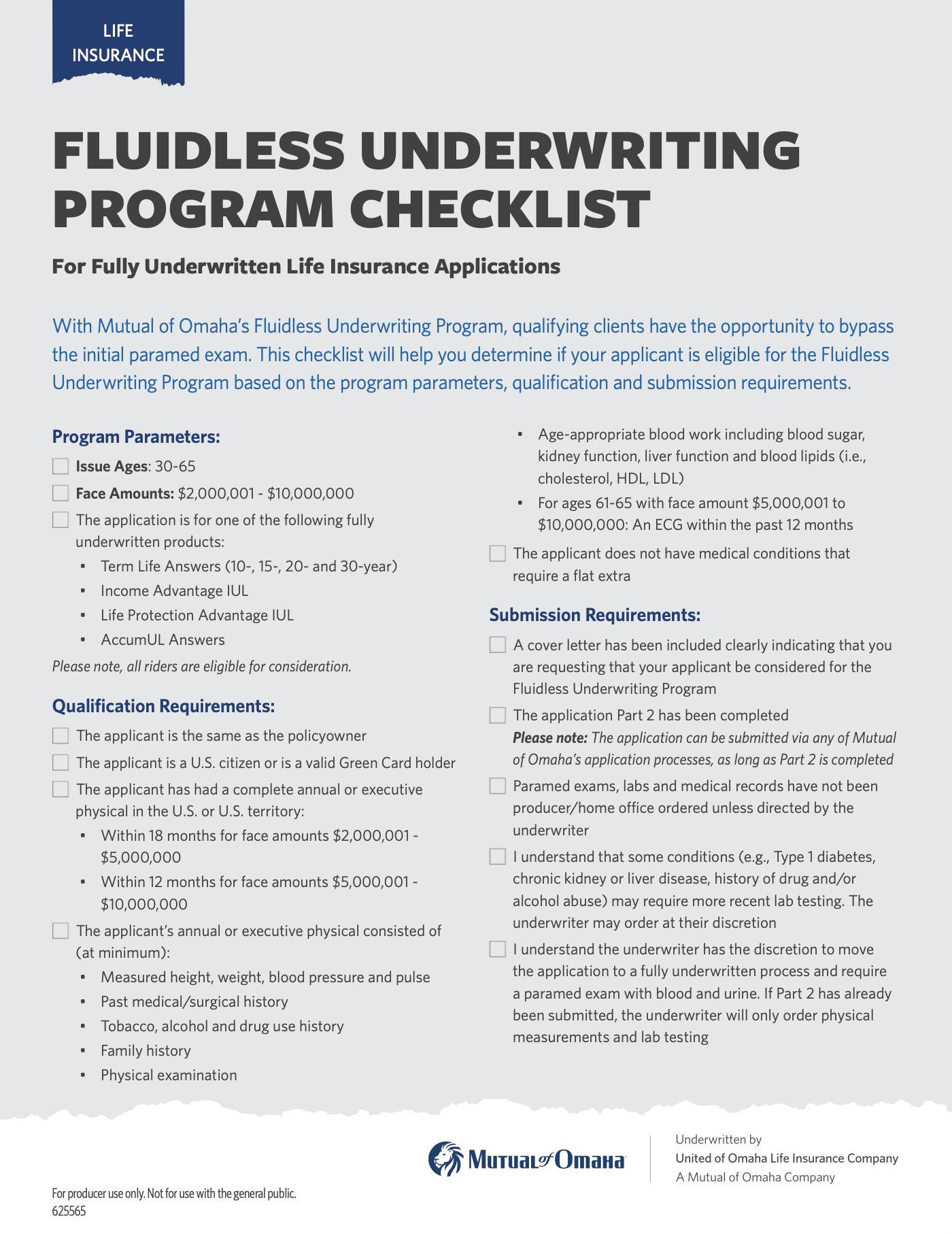

Fluidless Underwriting Program

Use this Fluidless Underwriting Program Checklist to determine if your Fully Underwritten Life Insurance applicants qualify to bypass the initial paramed exam. Face amounts must be between $2,000,001 and $10,000,000 and ages 30-65.

Accelerated Underwriting - Life Underwriting

Accelerated Underwriting - Life Underwriting

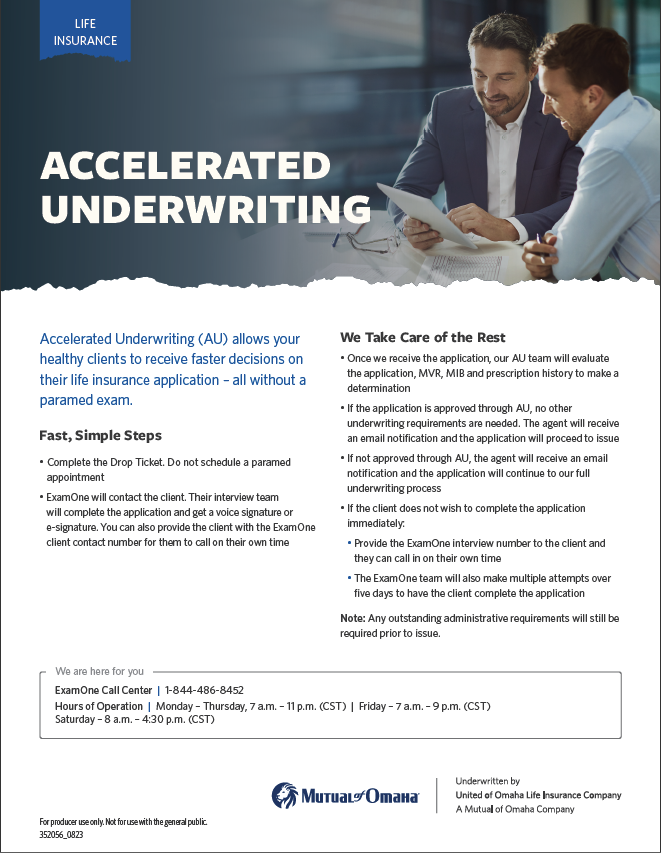

Accelerated Underwriting

Provides details for getting faster decisions for your Standard, Standard Plus, Preferred and Preferred Plus clients on Income AdvantageSM IUL, Life Protection AdvantageSM IUL, and Term Life Answers® Drop Tickets.

Web Content Viewer

Web Content Viewer

Error

Something went wrong - Please report this problem to the portal administrator.

Paramedical Vendors - Life Underwriting

Paramedical Vendors - Life Underwriting

Approved Paramedical Vendors

Paramedical Vendor FAQs - Life Underwriting

Paramedical Vendor FAQs - Life Underwriting

Approved Paramedical Vendor FAQs

Why is Mutual of Omaha selecting specific vendors as our approved paramedical examiners?

We're making this change in order to:

- provide you with expanded services

- reduce underwriting turnaround time

- integrate process efficiencies

- control the growth of underwriting department direct expenses

The combination of these factors contributes toward better product pricing.

How will this change benefit agents?

It will make it easier for you to do business. By that, we mean there will be:

- improved time-service quality (both in the home office and the field)

- a streamlined approach to ordering requirements

- reduced turnaround time from the ordering of a paramedical exam to the final underwriting decision

- real-time Web site access to examination appointment scheduling and underwriting requirements status

- a single point-of-contact relationship manager for problem resolution

Prompt and efficient electronic handling of paramedical exam and laboratory services allows us to reduce underwriting review process time.

How will this new approach improve accuracy and service time?

Within specified turnaround times, all paramedical and laboratory services will pass through a stringent quality assurance process. This makes certain that all results are complete the first time and minimizes the need for clarification, repeat requirements and requests for requirements that were overlooked. Additionally, results will be provided electronically, effectively eliminating misdirected (or lost) documentation.

What guarantees do we have that anticipated service levels will be met?

Each of our underwriting services providers has committed to a strict service-level agreement. Each vendor is dedicated not only to meeting but to exceeding these standards.

The Mutual program manager will review service-level standards to assure they're met or exceeded. Where issues surface, the program manager will determine whether the problem is an isolated circumstance that can be immediately rectified or will identify the root cause and resolve it.

Do we have to use an approved vendor or can we continue to use the paramed firm we're currently using?

These vendors have committed to provide you top-level service, faster turnaround and the ability to track the status of requests on line. If you don't use these vendors we can't guarantee the benefits and results other vendors offer.

Do I have to cancel the cases I currently have scheduled through non-approved paramed firms?

No. However, you should order all new requirements through approved vendors.

How do I request a paramedical exam?

Use the links above to the appropriate vendor Web site. (A one-time registration is required.) You can order examinations online. Or, you can phone, fax or e-mail examination requests.

How can I check on a paramedical exam's status?

Use the links above to the appropriate vendor Web site. (A one-time registration is required.) Sites provide real-time paramedical exam status.

What if I have concerns about the service I receive?

Call your Mutual home office relationship manager at (402) 351-5614.

Who do I contact if I have questions?

Contact Mutual's dedicated program manager, Tammy Richling, at (402) 351-5614.

Is it a good idea to pre-set paramed appointments with clients?

It's more efficient to allow the approved vendors' office to schedule a time with your client that will be mutually agreeable to both the client and the examiner. This arrangement allows for the appointment to take place earlier than a pre-scheduled date, in most cases.

Web Content Viewer

Web Content Viewer

Error

Something went wrong - Please report this problem to the portal administrator.

Log in for More

Log in for More

Login

Login

There's More

Log in to Sales Professional Access to unlock even more detailed information and specialized tools plus your personalized reports.

Not Registered? All you need is your production number and you're ready. Sign up

Contact Support

Contact Support

Have a sales or marketing question, need technical assistance, or have an idea you want to share? Contact Support

Shared State Special JS

Shared State Special JS

Web Content Viewer

Web Content Viewer

| This Web Content Viewer is associated with the current page. To associate web content, add content to the portal page by choosing Create Content from the current page in Site Manager. Alternatively, use the Content Spot dialog or the Edit Shared Settings mode of the Web Content Viewer to select the content to display. Learn More about Content Settings |